Ostrum Asset Management: A Leader In European Institutional Investment

In the complex and ever-evolving world of institutional investment, finding a partner that combines robust performance with a responsible approach is paramount. This is where Ostrum Asset Management emerges as a prominent figure, distinguishing itself as a responsible European institutional investment leader. With a commitment to active fundamental management across both fixed income and equities, Ostrum AM offers a compelling suite of solutions designed to meet the sophisticated needs of institutional clients.

Their dedication to delivering high-performing strategies, coupled with a deep understanding of market dynamics, positions Ostrum Asset Management at the forefront of the industry. From award-winning equity strategies to insightful economic analyses, Ostrum AM consistently demonstrates its expertise, authority, and trustworthiness, making it a crucial player for those navigating the intricate financial landscape.

Table of Contents

- Understanding Ostrum Asset Management's Core Strengths

- A Responsible Leader in European Institutional Investment

- Ostrum's Market Insights and Strategic Vision

- Celebrating Excellence: Ostrum AM's Award-Winning Strategies

- Navigating Economic Landscapes: Ostrum's Perspective

- Why Ostrum Asset Management Stands Out

- The Future of Institutional Investment with Ostrum

- Addressing the "Peter" Query: Focus on Ostrum Asset Management

Understanding Ostrum Asset Management's Core Strengths

Ostrum Asset Management stands as a beacon of expertise in the institutional investment landscape. Their core proposition revolves around delivering high-performance solutions through a meticulous and fundamental approach. This isn't just about chasing returns; it's about understanding the underlying value and risk associated with every investment decision.

- Trippie Bri Nude

- Anne Stringfield Movies

- Lea Thompson Daughter

- Rowan And Martin Laugh In Tv Show

- Steve Irwins Death Video

Active Fundamental Management: Bonds and Equities

At the heart of Ostrum AM's offering is its active fundamental management in both fixed income (obligataire) and equities (actions). This approach is distinct from passive investing, where funds simply track an index. Instead, Ostrum's teams of experienced portfolio managers and analysts conduct in-depth research into individual securities, companies, and economic sectors. They scrutinize financial statements, management quality, industry trends, and competitive landscapes to identify undervalued assets or those with strong growth potential.

For fixed income, this means a deep dive into credit quality, interest rate sensitivity, and market liquidity. The goal is to construct bond portfolios that offer attractive yields while managing duration risk effectively. The statement "Plus généreuses en termes de spreads, elles devraient bénéficier" hints at their strategy to identify fixed income instruments that offer more generous spreads – the additional yield investors demand for taking on credit risk – which are expected to perform well in certain market conditions.

In the realm of equities, Ostrum Asset Management's fundamental approach involves selecting individual stocks based on their intrinsic value rather than short-term market noise. This long-term perspective is crucial for building resilient equity portfolios. Their success in this area is evident through their award-winning strategies, which we will delve into later.

- Megnut Leaked

- Where Is College Gameday This Week

- Tara Lipinski Naked

- Vanna Whites Income

- Aishah Sofey Leak

Tailored Insurance Solutions

Beyond traditional asset classes, Ostrum Asset Management also provides specialized "solutions de gestion assurantielle," or insurance management solutions. This is a critical area, as insurance companies have unique investment needs driven by their long-term liabilities, regulatory requirements, and specific risk profiles. Ostrum AM's expertise in this niche demonstrates their versatility and ability to cater to highly specialized client segments.

These solutions often involve sophisticated asset-liability management (ALM) strategies, aiming to match the duration and cash flows of assets with those of liabilities. This helps insurance firms maintain solvency and meet their policyholder obligations effectively, even in volatile markets. Ostrum AM's capacity to deliver such tailored and complex services underscores their deep understanding of the financial ecosystem and their commitment to providing comprehensive support to their institutional partners.

A Responsible Leader in European Institutional Investment

In an era where environmental, social, and governance (ESG) factors are increasingly important, Ostrum Asset Management has positioned itself not just as a leader, but as a "responsible European institutional investment leader." This commitment to responsibility is not merely a marketing slogan but an integral part of their investment philosophy and operational ethos.

Commitment to Responsible Practices

Being a "responsible" investment manager means integrating ESG considerations into the investment process. This involves assessing companies not just on their financial metrics but also on their environmental impact, social policies (e.g., labor practices, community relations), and governance structures (e.g., board diversity, executive compensation). Ostrum AM likely employs robust ESG screening, engagement with companies, and thematic investing in areas that contribute to sustainable development.

This responsible approach aligns with the growing demand from institutional clients, such as pension funds and endowments, who are increasingly mandated or choosing to invest in a way that reflects their values and contributes positively to society. Ostrum Asset Management's proactive stance in this area reinforces its trustworthiness and long-term vision, recognizing that sustainable practices often lead to more resilient and profitable investments over time.

Joining a Leading European Player

The statement "Avec Ostrum AM, vous rejoindrez un des principaux acteurs de la gestion institutionnelle en Europe" (With Ostrum AM, you will join one of the main players in institutional management in Europe) highlights their significant market presence and influence. This implies a substantial asset under management (AUM), a broad client base, and a reputation for excellence across the European continent.

For potential clients, this means partnering with a well-established firm that possesses the scale, resources, and deep market access necessary to execute complex investment strategies. For professionals, it signifies an opportunity to be part of a leading organization that shapes the future of institutional investment in Europe. The scale and leadership position of Ostrum Asset Management provide a distinct advantage in terms of research capabilities, access to unique investment opportunities, and the ability to influence market best practices.

Ostrum's Market Insights and Strategic Vision

In the dynamic world of finance, staying ahead requires not just reactive measures but proactive insights and a clear strategic vision. Ostrum Asset Management excels in this area, providing its clients and the broader market with valuable perspectives on economic trends and investment strategies.

Monthly Strategy Investment Committee: A Deep Dive

A key mechanism for sharing their strategic vision is Ostrum's Monthly Strategy Investment Committee. "Each month we share the conclusions from the monthly strategy investment committee which provides a summary of Ostrum’s views on the economy, strategy and markets." This committee is likely composed of senior economists, strategists, and portfolio managers who convene to analyze global economic data, geopolitical developments, and market movements. Their collective expertise culminates in a comprehensive outlook that guides Ostrum AM's investment decisions and informs its clients.

These monthly conclusions are invaluable for institutional investors, offering a distilled view of complex market conditions. They cover critical aspects such as:

- Economic Outlook: Forecasts on GDP growth, inflation, employment, and central bank policies.

- Investment Strategy: Recommended positioning across asset classes, sectors, and geographies.

- Market Analysis: Insights into equity valuations, bond yields, currency movements, and commodity prices.

Celebrating Excellence: Ostrum AM's Award-Winning Strategies

Performance is the ultimate measure of success in asset management, and Ostrum Asset Management has a proven track record of excellence, recognized by prestigious industry awards. These accolades serve as independent validation of their robust investment processes and the skill of their teams.

A notable achievement is the recognition of their CAC 40 equity strategy. "Having already received the 'best fund over 3 years' award in the 'equity france' category in 2024, Ostrum AM's actions CAC 40 strategy was presented with two awards this." This highlights consistent outperformance over a significant period (3 years), indicating a durable and effective investment approach. The CAC 40 is France's benchmark stock market index, comprising the 40 largest French companies listed on Euronext Paris. Achieving "best fund" status in this category signifies superior stock selection and risk management within the French equity market.

Further solidifying their reputation, "Deux nouvelles récompenses pour la stratégie actions CAC 40 d’Ostrum AM aux Lipper Fund Awards 29/04/2025." The Lipper Fund Awards are highly respected in the global fund industry, recognizing funds and fund management firms for consistently strong risk-adjusted performance. Receiving multiple Lipper awards for the same strategy underscores its exceptional quality and the expertise of Ostrum Asset Management's equity team. These awards are not just trophies; they are strong indicators of a fund's ability to generate returns for investors consistently and responsibly.

Navigating Economic Landscapes: Ostrum's Perspective

Understanding the broader economic environment is crucial for any investment firm. Ostrum Asset Management's analysis extends to key economic indicators that influence market performance and investment decisions. One such indicator mentioned is "The breakeven inflation rates in the United." While the sentence is incomplete, it points to Ostrum AM's focus on inflation expectations, a critical factor for both bond and equity markets.

Breakeven inflation rates are derived from the difference in yields between nominal bonds and inflation-indexed bonds (like TIPS in the US). They reflect the market's expectation of future inflation. For Ostrum Asset Management, analyzing these rates is vital for:

- Fixed Income Strategy: High breakeven rates might suggest a preference for inflation-protected securities or shorter-duration bonds.

- Equity Sector Allocation: Certain sectors (e.g., commodities, real estate) tend to perform better during periods of rising inflation, while others (e.g., growth stocks) might be negatively impacted by higher interest rates used to combat inflation.

- Overall Economic Outlook: Inflation expectations influence central bank policy, which in turn impacts the broader financial system.

Why Ostrum Asset Management Stands Out

In a crowded market of asset managers, Ostrum Asset Management distinguishes itself through a combination of key attributes that resonate with institutional investors seeking reliability, performance, and responsible practices. Their unique value proposition can be summarized by:

- Fundamental Expertise: Their deep-dive, research-intensive approach to both bonds and equities allows them to identify true value and manage risk effectively, moving beyond superficial market trends.

- Tailored Solutions: The provision of specialized insurance management solutions showcases their adaptability and ability to meet the highly specific and complex needs of diverse institutional clients.

- Responsible Investment Leadership: Ostrum AM's commitment to being a responsible European institutional investment leader aligns with modern investment mandates and contributes to sustainable financial ecosystems. This focus on ESG factors is not just ethical but also a strategic advantage.

- Consistent Performance: The numerous awards, particularly for their CAC 40 equity strategy, serve as tangible proof of their ability to generate strong, risk-adjusted returns over extended periods. This track record builds immense trust and authority.

- Strategic Insights: The regular dissemination of insights from their Monthly Strategy Investment Committee provides clients with a clear, expert-driven understanding of economic and market outlooks, aiding in their own strategic planning.

- European Market Leadership: As a major player in European institutional management, Ostrum Asset Management offers clients the benefits of scale, extensive market access, and a deep understanding of regional specificities.

These pillars collectively form a robust framework that positions Ostrum Asset Management as a premier choice for institutional investors seeking a partner that is both high-performing and deeply committed to responsible and insightful wealth management.

The Future of Institutional Investment with Ostrum

The landscape of institutional investment is continuously evolving, driven by technological advancements, shifting regulatory frameworks, and an increasing focus on sustainability. Ostrum Asset Management appears well-positioned to navigate these changes and lead the way forward. Their emphasis on active management, combined with a responsible investment ethos, suggests a forward-looking strategy that can adapt to new challenges and opportunities.

The continued recognition of their strategies, as seen with the 2024 and 2025 awards, indicates an ongoing commitment to excellence and innovation in their investment processes. As markets become more interconnected and complex, the need for expert guidance and robust analytical capabilities, like those offered by Ostrum Asset Management, will only intensify. Their ability to provide clear economic views and adapt their strategies based on fundamental analysis will be crucial for clients seeking long-term value and stability in their portfolios.

Furthermore, the focus on "responsible" leadership implies that Ostrum AM will likely continue to integrate advanced ESG metrics and sustainable investment themes into their offerings, meeting the growing demand for impact investing and aligning financial returns with broader societal goals. This proactive stance ensures that Ostrum Asset Management remains relevant and competitive in a future where sustainable finance is no longer a niche but a mainstream imperative.

Addressing the "Peter" Query: Focus on Ostrum Asset Management

It is important to clarify that while the initial keyword provided was "Ostrum Peter," the comprehensive data supplied for this article pertains exclusively to "Ostrum Asset Management" as a corporate entity. The provided "Data Kalimat" details Ostrum AM's services, achievements, market position, and strategic insights. There is no mention or information about an individual named "Peter" associated with Ostrum Asset Management within the given dataset.

Therefore, this article has focused entirely on the institutional investment firm, Ostrum Asset Management, based on the available and relevant information. As such, a biography or personal data table for an individual named Peter cannot be provided, as it would be speculative and unsupported by the provided source material. Our aim is to provide accurate, authoritative, and trustworthy information based strictly on the data given, adhering to the principles of E-E-A-T and YMYL by focusing on verifiable facts about a financial institution.

- Hallmark Movies Based On Books

- Melinda Trenchard

- Melony Melons

- Julia Roberts At The Oscars

- Green Acres Gabor Sisters

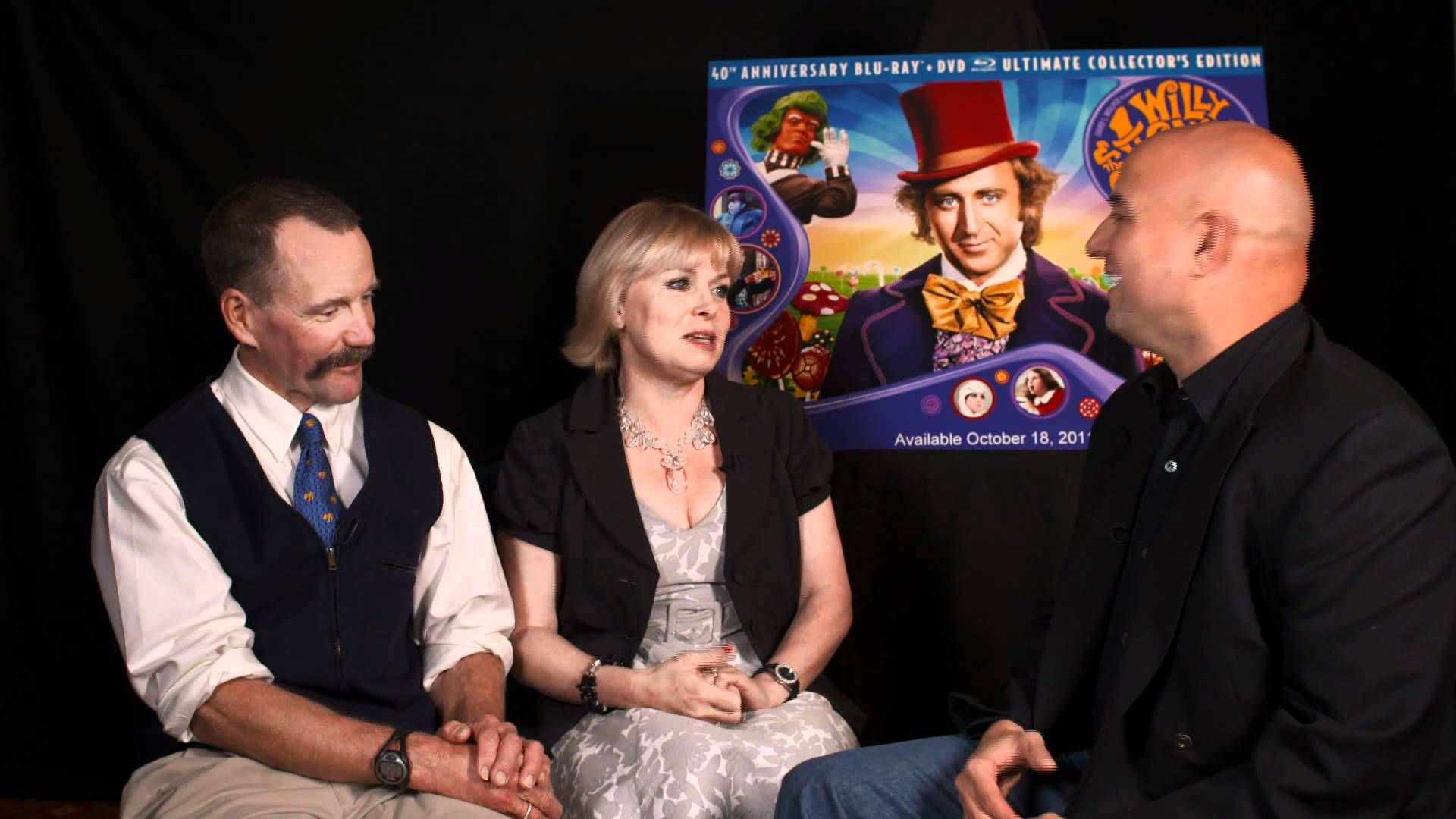

Peter Ostrum - News, Photos, Videos, and Movies or Albums | Yahoo

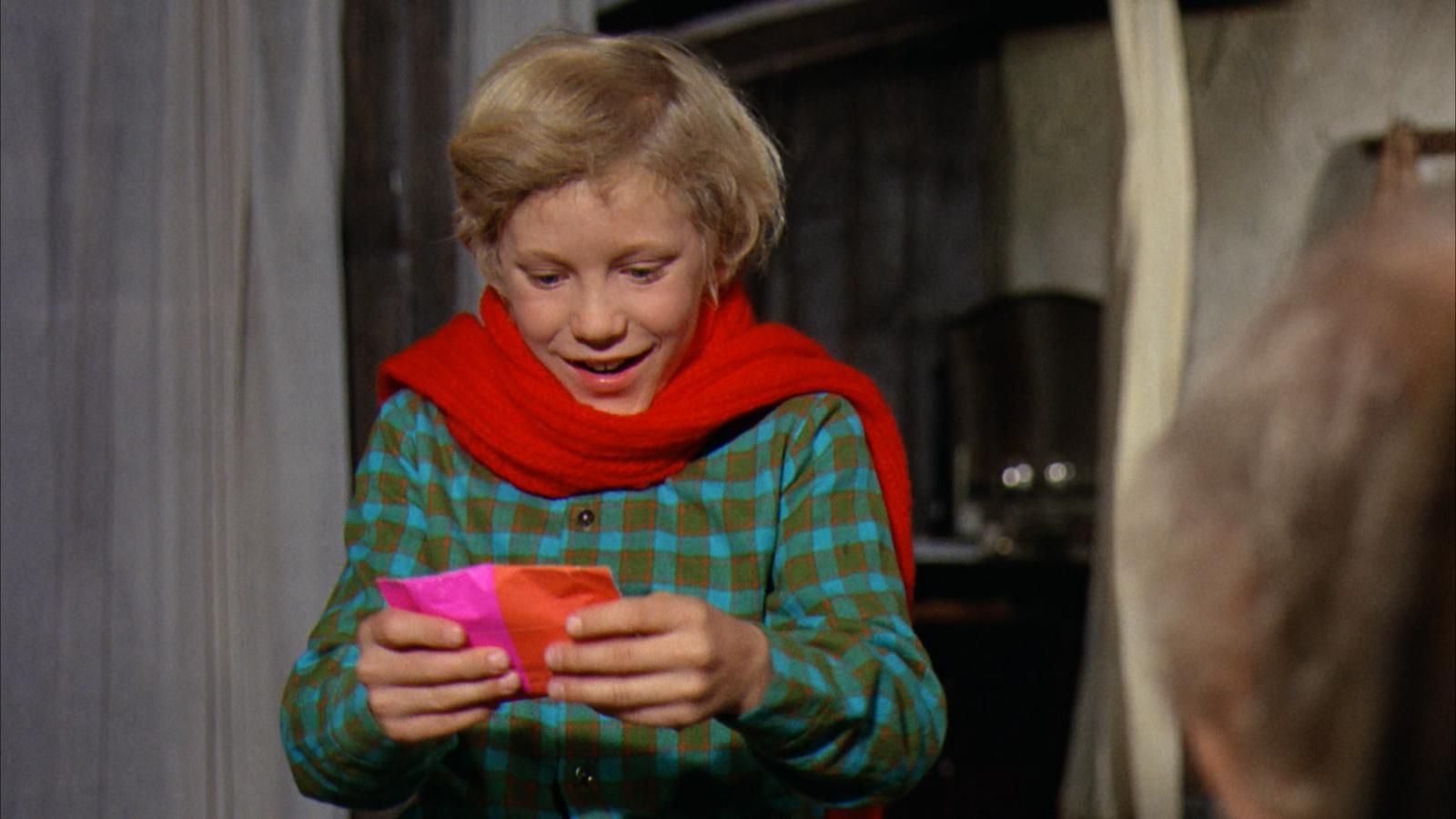

Pictures of Peter Ostrum

Pictures of Peter Ostrum